Frequently Asked Questions (FAQs)

- What is instaPay?

instaPay is an Electronic Fund Transfer (EFT) service that enables a customer of a participating BSP-supervised financial institution (BSFI) to transfer Philippine Peso funds from his account to an account in another participating BSFI. The transferred funds are made available to the recipient in real-time. BSFIs may be banks or electronic money issuers (EMIs) such as PayMaya or Omnipay.

instaPay is part of the National Retail Payments System (NRPS) initiative of the Bangko Sentral ng Pilipinas (BSP) that seeks to promote electronic payments.

- What is PESONet?

Meanwhile, the batch electronic fund transfer or PESONet facilitates fund transfer from one (1) account (payor) to one or several accounts (payee/s). The fund transfer and/or payment instructions are processed in bulk and cleared at batch intervals with each payee receiving the full value in their account. This facility supports payments that are recurring and are not time-critical, thus serving as a channel for government collections and disbursements and an alternative to the overwhelming use of checks by businesses.

- instaPay and PESONet use cases:

- Inter-bank transfers

- Person-to-Person, Person-to-Business, Business-to-Business, and Business-to-Person payments

- Domestic remittance

- Payment to service providers such as plumbers, electricians, carpenters, etc. e) Face-to-face payment for goods (e.g. sari-sari stores, bazaars, garage sales)

- Payroll

- Donation to charitable organizations

- How will customers transfer funds through instaPay and PESONet?

Customers can transfer funds through instaPay and PESONet by using electronic channels provided by their banks or EMIs, such as internet banking and mobile applications. In the case of EqB, customers must do the following steps:

- Visit any EqB branch

- Fill-out and sign the instaPay/PESONet Application Form (refer to Annex 1)

- Present the filled-out and signed application form to the branch personnel for processing

- Branch acceptance of instaPay and PESONet transactions is until 3:30 PM

- After the transaction is processed, a service of fifteen pesos (P15.00) will be debited from the sender’s EqB account.

- What if the Payor is not a client of EqB, will we allow him/her to use instaPay/PESONet?

Only existing EqB customers may be able to perform funds transfer through instaPay and PESONet. The source account must be maintained at any EqB branch, active, and well-funded.

- Do I need to enroll the accounts that I want to transfer to?

Customers don’t need to enroll their accounts whenever they want to do funds transfer via instaPay or PESONet. For as long as the source/originating account is active and well-funded.

- What are the needed information to process an instaPay/PesoNet transaction?

- Transaction Date

- Transaction Amount

- Receiver’s Name

- Receiver’s Account Number

- Receiver’s Address

- Sender’s Name

- Sender’s Account Number

- Sender’s Address

- Recipient’s Bank Name

- Purpose of Transfer

- Is there a limit to the amount that can be transferred?

The maximum that can be transferred for instaPay is fifty thousand pesos (P50,000.00) per transaction. While PESONet does not have any transaction limit. No daily sending limit. No limit to the number of transfers that can be made in a day.

- What is the instaPay/PESONet fee for the customer?

- Sending customer – P15.00 for both instaPay and PESONet

- Receiving customer – None

- How will the customer know if the instaPay and PESONet transaction is successful?

Customer may validate from the receiver if the fund was successfully credited to the destination account.

- Can an instaPay and PESONet transaction get rejected?

Yes.

- What if the customer’s instaPay and PESONet request is not successful, how will the money be refunded?

If the beneficiary bank rejects the fund transfer because of an invalid account number, the amount will be returned to the customer’s account on the next banking day.

- What if the customer entered the wrong account number, how will the customer recover the fund?

Inform EqB branch personnel immediately of the incident. Provide the following information:

- Date of transaction

- Source account number

- Wrong beneficiary account number to which funds were transferred to

- Name of the beneficiary bank and location

- Transferred amount

- Transaction reference number, if available

Note: EqB will do on a best effort basis to retrieve the funds which were transferred to the wrong account.

- Are instaPay and PESONet secure?

Yes, instaPay and PESONet are secure and have the same level of security standards as the inter-bank funds transfer service currently provided by BSFIs.

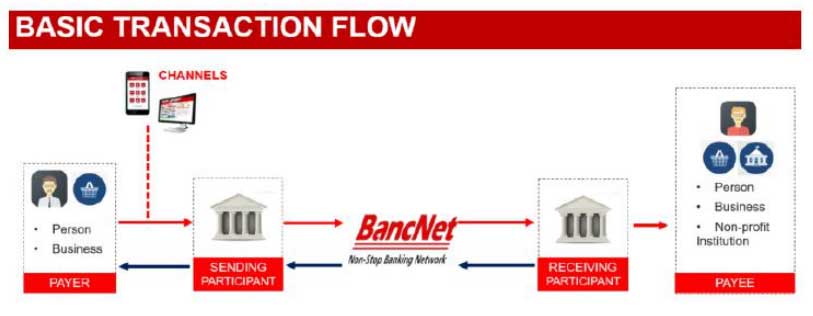

- How does instaPay work?

The sender’s financial institution will debit his account and instantly transfer the fund to the recipient’s financial institution which will then make this instantly available to the latter’s account specified by the sender. The recipient may use the transferred fund for electronic payments or withdraw it either over the counter or from any ATM.

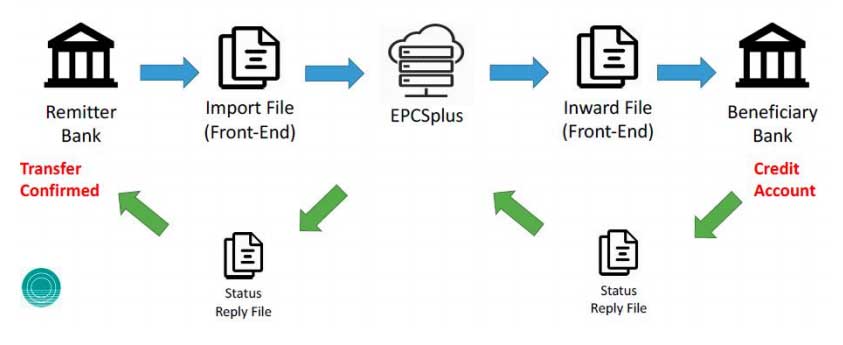

- How does PESONet work?

PESONet also also observes a real-time push credit to the beneficiary banks. However, unlike instaPay, PESONet carries the “settle before clear” process. It guarantees funds are available at certain period after settlement.

- Differences Between instaPay and PESONet

instaPay PESONet Availability Banking days only Banking days only Availability of Funds at Beneficiary Bank* Monday to Friday

Before 2:00 PMImmediate Funds are available to the recipient’s account within the same banking day or after clearing cycle at batch intervals (10:00 AM and 4:00PM). Transactions processed after 4:00 PM will be credited the next banking day Monday to Friday

After 2:00 PMImmediate Next banking day Weekends and

HolidaysNext banking day Next banking day *The processing time depends on the time the transaction was requested and how long the beneficiary bank processes the transaction. Eligible EqB Source Account Peso Savings Account

Peso Checking AccountPeso Savings Account

Peso Checking AccountPayment Transmission to Clearing Switch Operator (CSO) Sent electronically individually to the CSO Sent electronically, batch or individually, to the CSO Crediting of Beneficiary Account Real-time credit, will not wait for settlement or “clear before settle” Payment is credited in full

Credit is done only after successful settlement or “settle before clear” Payment is credited in full

Transaction Limit P50,000.00 per transaction No limit Transaction Fee P15.00 per transaction P15.00 per transaction Clearing Switch Operator (CSO) BancNet Philippine Clearing House Corporation (PCHC)

Equicom Savings Bank is regulated by the Bangko Sentral ng Pilipinas (BSP) with contact number (632) 8708-7087 and email address consumeraffairs@bsp.gov.ph.