Equicom Advisory

Bayanihan to Heal as One Act

1. Which types of financial institutions (FIs) are covered by the IRR of Section 4(aa) of the “Bayanihan to Heal As One Act?”

A: For purposes of BSP implementation of the IRR, it shall cover all BSP-Supervised Financial Institutions (BSFIs) with lending operations. These include banks, quasi-banks, non-stock savings and loan associations, credit card issuers, trust departments/corporations, pawnshops, and other credit-granting entities under the supervision of BSP.

2. Does the IRR apply to loans extended by banks abroad to Filipino residents?

A: No, the IRR applies only to loans extended by FIs established in the Philippines.

3. Will the IRR cover loans of borrowers who have been previously required by lending institutions to execute a waiver of their right to avail of the benefits of the grace period granted under Section 4(aa) of the “Bayanihan to Heal as One Act” prior to the effectivity of the IRR?

A: Yes, the loans will still be covered by the mandatory 30-day grace period notwithstanding the execution by the borrower of a waiver prior to the issuance of the IRR. Section 3.03 of the IRR states that “no waiver previously executed by borrowers covering payments falling due during the ECQ period shall be valid.” Effectively, any waiver previously executed by borrowers covering loan payments falling due during the Enhanced Community Quarantine (ECQ) period shall be considered void. Nonetheless, borrowers may still choose to pay their obligations as they fall due during the ECQ period.

4. Does the IRR apply to all loan accounts whether current or past due?

A: Yes, the IRR covers all accounts regardless of whether these are current or past due.

5. Are loan accounts covered by post-dated checks, auto-debit or auto deduct arrangements with lending FIs covered by the IRR?

A: Yes, the IRR covers loan accounts with issued post-dated checks and those with auto-debit or auto deduct arrangements. In this case, FIs are advised to coordinate with their clients if they wish to proceed with the arrangement despite the mandatory 30-day grace period granted by law. FIs shall also coordinate with their clients if they wish to reverse checks cleared or payments debited/deducted prior to the enactment of the Bayanihan Act and its IRR, during the mandatory 30-day grace period. The reversal shall be done without corresponding fees and charges.

6. Are fees/charges related to loans extended or credit lines granted (e.g. credit card renewal fees) scheduled to be paid to during the ECQ period covered by the IRR?

A: Yes, fees and charges related to loans extended or credit lines granted are covered by the IRR.

7. How will the curing period of banks provided under Section 304 on Past Due Accounts and Non-Performing Loans of the New Manual of Regulations for Banks (MORB) be relevant in the application of the IRR? Can the 30-day curing period provided by banks to past due accounts be considered as a form of compliance with Section 4(aa) of the “Bayanihan to Heal as One Act” and its IRR? Or would it be added to the 30-day grace period provided by the subject law?

A: The 30-day mandatory grace period under the law effectively moves the payment due date. The curing period provided under Section 304 of the MORB will be applied based on the new due date of the account.

8. Are banks required to include in their letters of request for regulatory relief the application of the grace period even if this is already mandated under the “Bayanihan to Heal As One Act” and its IRR?

A: No. Banks are not required to request for application of 30-day grace period under the Act.

9. When will the 30-day grace period commence? Will it be from payment due date or from end of the ECQ?

A: The 30-day grace period shall commence from the payment due date falling within the ECQ period.

10. Will the principal amount payable during the grace period be added to the principal amount due in the next payment due date or will the final due date of the entire loan move by 30 days?

A: The last payment due date will move by 30 days. Interest accrued during the 30 day mandatory grace period may be paid in lump sum on the new date or on a staggered basis over the remaining term of the loan. Please refer to the example provided.

Example: A 5-year loan, with remaining maturity life of 4 years. If the monthly amortization of the loan due on 2 April 2020 is P10,500.00 with a portion applied to payment of the principal (e.g., P10,000) and monthly interest (e.g., P500):

a. What will the new due date be applying the 30-day grace period?

A: 2 May 2020

b. How much will the borrower pay on the next due date?

A: Principal for 1 month plus interest for 2 months (10,000 + 500 + 500 = 11,000) OR

Principal for 1 month plus interest for 1 month plus interest for 1month/(4 yrs x 12 months) (10,000 + 500 + (500/(4x12) = 10,510.42)

(Assuming that the principal and interest are constant at P10,000 and P500, respectively.)

This will move the due date of the last payment due by 30 days, e.g if the last payment is due on 2 April 2024 before the application of the 30 day grace period, it will now be 2 May 2024.

11. Will amortizations be rescheduled in line with the 30-day grace period (i.e., plus one period for monthly amortizations)? Do BSFIs need to issue new Promissory Notes/Disclosure statements for the new amortization schedule?

A: Yes. The amortizations will be effectively rescheduled in accordance with the 30-day grace period. Please refer to the example provided in Item no. 10. There is no need to issue new Promissory Notes/Disclosure statements.

12. How will the IRR provisions apply to loans other than those amortized monthly (i.e., quarterly, semestral)?

A: The 30-day grace period will apply to all loans regardless of its amortization schedule, as long as the due date falls within the ECQ. FIs will add 30 days to the due date falling within the ECQ period to determine the new due date.

13. With respect to Section 5.02 of the IRR, how will the accrued interest be amortized over the remaining life of the loan? Do loan schedules need to be revised?

A: Please refer to Item nos. 10 and 11.

14.Will the accounts applying the 30-day mandatory grace period be included in the past due loan (PDL) ratio computation and do banks need to apply for exclusion of the accounts as PDL?

A: No. The accounts applying the 30-day grace period will not be included in the PDL ratio computation. Likewise, banks no longer need to apply for exclusion of the accounts in the computation of the PDL ratio.

15. Do borrowers need to apply or request for approval from the lending FI for the application of the 30-day grace period?

A: No. The 30-day grace period will automatically be applied by all lending FIs.

16. For credit card revolvers (i.e., borrowers that do not pay in full every payment period), will interest on their outstanding balances continue to accrue during the 30-day grace period?

A: Under the IRR, interest will continue to accrue and this will be payable on the next due date, following the application of the 30-day grace period, either in lump sum or on staggered basis.

17. For credit card transactors, will interest accrue on the outstanding balance during the 30-day grace period?

A: Credit card transactors will not be charged any interest during the 30-day grace period if they pay the total outstanding balance on or before the new due date.

Notice on Credit Card SOA Delivery

Due to the extended Enhanced Community Quarantine (ECQ), all our partner couriers have temporarily suspended its operations. Please expect a delay in the delivery of your credit card Statement of Account (SOA).

If you want to know your latest outstanding balance, available credit limit, or how to make a payment, please call the Equicom 24/7 Customer Service at (632) 8241-5952, (632) 8241-6711, or login to your Online Banking account.

Stay safe and stay home.

Equicom Savings Bank is regulated by the Bangko Sentral ng Pilipinas (BSP) with contact number (632) 8708-7087 and email address consumeraffairs@bsp.gov.ph.

Notice on ATM Operations

With the situation surrounding COVID-19 continuing to develop, our Automated Teller Machines (ATMs) nationwide will remain open during these challenging times. Visit our Branch and ATM page for locations and updates of our ATMs.

We encourage our customers to stay at home and visit our branches and ATM locations only if necessary.

Luzon

ON-SITE: Main Office Branch, Alabang, Calamba, Diliman and Legarda

OFF-SITE: (1) ALGO Center, (2) Arellano University, (3) Asian Hospital and Medical Center, (4) Calamba Medical Center*, (5) Chinese General Hospital, (6) CIBI Information Center, (7) La Consolacion College Manila, (8) Makati Medical Center, (9) Maxicare Tower, (10) MyHealth Clinic Shangri-La Plaza, (11) National Teachers College, (12) San Beda College Manila, (13) The Landmark – Makati, (14) The Landmark – Trinoma, and (15) The Medical City*

Visayas

ON-SITE: Cebu, Iloilo, and Mandaue

OFF-SITE: AppleOne-Equicom Tower (Cebu)*

Mindanao

ON-SITE: Davao

*Under Maintenance

Customers can access their accounts through secure banking alternatives such as Online Banking, Phone Banking, and BancNet Online. To know more, please call the Equicom 24/7 Customer Service at (632) 8241-5952, (632) 8241-6711, or DTF 1-800-10-EQUICOM (3784266).

Thank you for usual cooperation and understanding.

Equicom Savings Bank is regulated by the Bangko Sentral ng Pilipinas (BSP) with contact number (632) 8708-7087 and email address consumeraffairs@bsp.gov.ph.

Notice on Extended Due Dates for Credit Cards and Loans

Pursuant to the Bayanihan to Heal as One Act and with the Enhanced Community Quarantine due to the COVID-19 threat, Equicom Savings Bank (EqB) is extending payments for credit cards and loans by at least 30 days.

Credit Cards

- Late payment fees will be waived

- Any reversals will be posted on the next statement of account

- For cardholders who wish to settle their outstanding balances based on their due dates may do so. Payments can be made through EqB branches, our partner banks, and accredited payment centers

Auto Loan, Home Loan, Personal Loan*, and SME Business Loan*

- *Payment extension will be applied on accounts with cutoff dates falling between April 3 and May 4, 2020

- *Auto-debit payment instructions and post-dated checks (PDCs) from April 3 to May 4, 2020 will be held

- *Loan maturity will be extended and issuance of new PDCs may be required

- *Borrowers who wish to deposit their April 2020 PDCs may do so with prior call or email to the Equicom 24/7 Customer Service

- Any penalties will be waived

For assistance and payment options, please call the Equicom 24/7 Customer Service at (632) 8241-5952, (632) 8241-6711, or DTF 1-800-10-EQUICOM (3784266) or email us at customerservice@equicomsavings.com.ph.

Equicom Savings Bank is regulated by the Bangko Sentral ng Pilipinas (BSP) with contact number (632) 8708-7087 and email address consumeraffairs@bsp.gov.ph.

Notice on instaPay and PESONet Service Fees

To further support our customers who are impacted financially due to the effects of the COVID-19 pandemic, we are waiving the instaPay and PESONet service fees* for personal/individual account transfers done via Online Banking, until further notice.

Login now to your Online Banking account and start sending money to any local bank.

To know more, please call the Equicom 24/7 Customer Service at (632) 8241-5952, (632) 8241-6711, or DTF 1-800-10-EQUICOM (3784266).

*Over-the-counter (OTC) and Corporate account funds transfers are excluded.

Equicom Savings Bank is regulated by the Bangko Sentral ng Pilipinas (BSP) with contact number (632) 8708-7087 and email address consumeraffairs@bsp.gov.ph.

Notice on COVID-19 Phishing Scams

There is a surge of COVID-19 phishing emails and SMS which include malicious messages purportedly sent on behalf by Equicom Savings Bank (EqB).

EqB will never ask you for your personal identification number (PIN), one-time password (OTP), online banking password, or request you to move money from your accounts. Do not click on links or attachments in suspicious emails and never respond to unsolicited messages and calls that ask for your personal or financial details.

Report phishing attempts immediately to your branch of account or through the Equicom 24/7 Customer Service at (632) 8241-5952, (632) 8241-6711, and DTF 1-800-10-EQUICOM (3784266).

Equicom Savings Bank is regulated by the Bangko Sentral ng Pilipinas (BSP) with contact number (632) 8708-7087 and email address consumeraffairs@bsp.gov.ph.

Notice on Response to COVID-19

Notice on Adjusted Banking Hours

New Late Payment Fee

Effective December 6, 2018, if you pay less than or fail to pay the minimum amount due (MAD), a Late Payment Interest of 6.0% of the MAD or Five Hundred Pesos (PhP500.00) fixed amount, whichever is lower, will be imposed on the credit card account and will be reflected in the next cycle’s SOA.

Equicom Savings Bank is regulated by the Bangko Sentral ng Pilipinas (BSP) with contact number (632) 8708-7087 and email address consumeraffairs@bsp.gov.ph.

instaPay and PESONet FAQs

Frequently Asked Questions (FAQs)

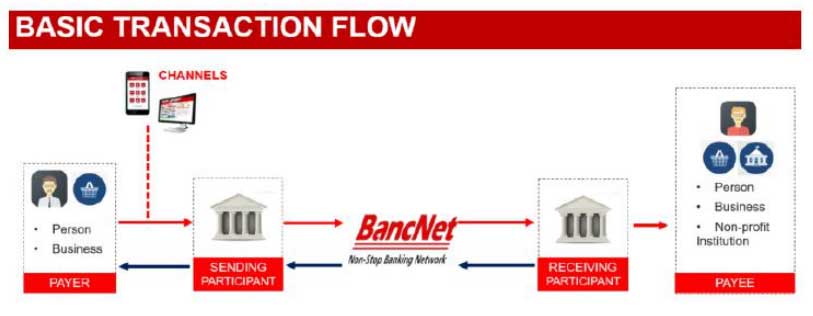

- What is instaPay?

instaPay is an Electronic Fund Transfer (EFT) service that enables a customer of a participating BSP-supervised financial institution (BSFI) to transfer Philippine Peso funds from his account to an account in another participating BSFI. The transferred funds are made available to the recipient in real-time. BSFIs may be banks or electronic money issuers (EMIs) such as PayMaya or Omnipay.

instaPay is part of the National Retail Payments System (NRPS) initiative of the Bangko Sentral ng Pilipinas (BSP) that seeks to promote electronic payments.

- What is PESONet?

Meanwhile, the batch electronic fund transfer or PESONet facilitates fund transfer from one (1) account (payor) to one or several accounts (payee/s). The fund transfer and/or payment instructions are processed in bulk and cleared at batch intervals with each payee receiving the full value in their account. This facility supports payments that are recurring and are not time-critical, thus serving as a channel for government collections and disbursements and an alternative to the overwhelming use of checks by businesses.

- instaPay and PESONet use cases:

- Inter-bank transfers

- Person-to-Person, Person-to-Business, Business-to-Business, and Business-to-Person payments

- Domestic remittance

- Payment to service providers such as plumbers, electricians, carpenters, etc. e) Face-to-face payment for goods (e.g. sari-sari stores, bazaars, garage sales)

- Payroll

- Donation to charitable organizations

- How will customers transfer funds through instaPay and PESONet?

Customers can transfer funds through instaPay and PESONet by using electronic channels provided by their banks or EMIs, such as internet banking and mobile applications. In the case of EqB, customers must do the following steps:

- Visit any EqB branch

- Fill-out and sign the instaPay/PESONet Application Form (refer to Annex 1)

- Present the filled-out and signed application form to the branch personnel for processing

- Branch acceptance of instaPay and PESONet transactions is until 3:30 PM

- After the transaction is processed, a service of fifteen pesos (P15.00) will be debited from the sender’s EqB account.

- What if the Payor is not a client of EqB, will we allow him/her to use instaPay/PESONet?

Only existing EqB customers may be able to perform funds transfer through instaPay and PESONet. The source account must be maintained at any EqB branch, active, and well-funded.

- Do I need to enroll the accounts that I want to transfer to?

Customers don't need to enroll their accounts whenever they want to do funds transfer via instaPay or PESONet. For as long as the source/originating account is active and well-funded.

- What are the needed information to process an instaPay/PesoNet transaction?

- Transaction Date

- Transaction Amount

- Receiver’s Name

- Receiver’s Account Number

- Receiver’s Address

- Sender’s Name

- Sender’s Account Number

- Sender’s Address

- Recipient’s Bank Name

- Purpose of Transfer

- Is there a limit to the amount that can be transferred?

The maximum that can be transferred for instaPay is fifty thousand pesos (P50,000.00) per transaction. While PESONet does not have any transaction limit. No daily sending limit. No limit to the number of transfers that can be made in a day.

- What is the instaPay/PESONet fee for the customer?

- Sending customer - P15.00 for both instaPay and PESONet

- Receiving customer - None

- How will the customer know if the instaPay and PESONet transaction is successful?

Customer may validate from the receiver if the fund was successfully credited to the destination account.

- Can an instaPay and PESONet transaction get rejected?

Yes.

- What if the customer’s instaPay and PESONet request is not successful, how will the money be refunded?

If the beneficiary bank rejects the fund transfer because of an invalid account number, the amount will be returned to the customer’s account on the next banking day.

- What if the customer entered the wrong account number, how will the customer recover the fund?

Inform EqB branch personnel immediately of the incident. Provide the following information:

- Date of transaction

- Source account number

- Wrong beneficiary account number to which funds were transferred to

- Name of the beneficiary bank and location

- Transferred amount

- Transaction reference number, if available

Note: EqB will do on a best effort basis to retrieve the funds which were transferred to the wrong account.

- Are instaPay and PESONet secure?

Yes, instaPay and PESONet are secure and have the same level of security standards as the inter-bank funds transfer service currently provided by BSFIs.

- How does instaPay work?

The sender’s financial institution will debit his account and instantly transfer the fund to the recipient’s financial institution which will then make this instantly available to the latter’s account specified by the sender. The recipient may use the transferred fund for electronic payments or withdraw it either over the counter or from any ATM.

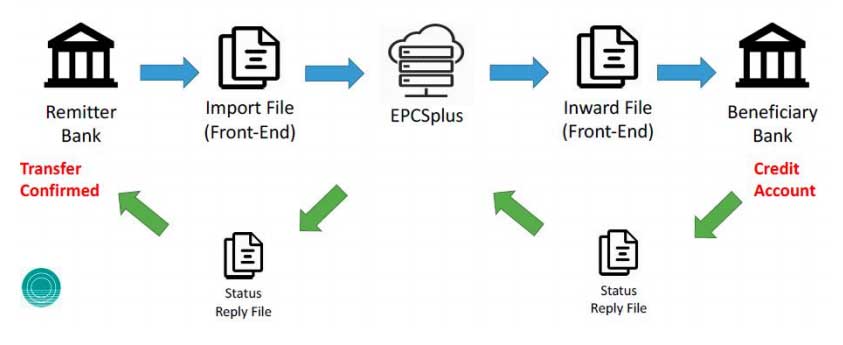

- How does PESONet work?

PESONet also also observes a real-time push credit to the beneficiary banks. However, unlike instaPay, PESONet carries the “settle before clear” process. It guarantees funds are available at certain period after settlement.

- Differences Between instaPay and PESONet

instaPay PESONet Availability Banking days only Banking days only Availability of Funds at Beneficiary Bank* Monday to Friday

Before 2:00 PMImmediate Funds are available to the recipient’s account within the same banking day or after clearing cycle at batch intervals (10:00 AM and 4:00PM). Transactions processed after 4:00 PM will be credited the next banking day Monday to Friday

After 2:00 PMImmediate Next banking day Weekends and

HolidaysNext banking day Next banking day *The processing time depends on the time the transaction was requested and how long the beneficiary bank processes the transaction. Eligible EqB Source Account Peso Savings Account

Peso Checking AccountPeso Savings Account

Peso Checking AccountPayment Transmission to Clearing Switch Operator (CSO) Sent electronically individually to the CSO Sent electronically, batch or individually, to the CSO Crediting of Beneficiary Account Real-time credit, will not wait for settlement or “clear before settle” Payment is credited in full

Credit is done only after successful settlement or “settle before clear” Payment is credited in full

Transaction Limit P50,000.00 per transaction No limit Transaction Fee P15.00 per transaction P15.00 per transaction Clearing Switch Operator (CSO) BancNet Philippine Clearing House Corporation (PCHC)

Equicom Savings Bank is regulated by the Bangko Sentral ng Pilipinas (BSP) with contact number (632) 8708-7087 and email address consumeraffairs@bsp.gov.ph.

Notice on Cardholder Verification Method For EMV Cards

Effective July 1, 2018, all domestic Point-of-Sale (POS) transactions using your Equicom Savings Bank (EqB) debit and prepaid cards will require Personal Identification Number (PIN) as the primary cardholder verification method (CVM).

-

ATM / Debit Card -

Prepaid Card

Signature will remain as the secondary CVM in cases when the POS terminal is not yet capable of online PIN verification.

This is in compliance with BSP Memorandum No. M-2016-011 dated 31 August 2016.

We are glad to serve your banking needs and thank you for your continuous patronage.

Equicom Savings Bank is regulated by the Bangko Sentral ng Pilipinas (BSP) with contact number (632) 8708-7087 and email address consumeraffairs@bsp.gov.ph.

Watch out for Phishing and Spoofing

At Equicom Savings Bank (EqB), the security of your identity and accounts is important to us. To complement the security features, systems and best practices implemented by EqB, we encourage you to look for the following signs in your messages to identify ”phishing” and "spoofing” scams.

- Requests for your personal information such as user name, password, account number, card number, PIN, birthday, CVV code or request to transfer money.

- Generic greeting, misspelling or bad grammar and suspicious salutation.

- Unsolicited message that contains links, attachments, and clickable images. Do not click any of these within the e-mail.

- Message that looks entirely different from the other messages that you have received from your bank.

- Message that intends to deceive the customer that his/her account has unauthorized transaction/s and needs immediate updates.

Report phishing and spoofing attempts immediately to your branch of account, Equicom 24/7 Customer Service at (632) 8241-5952, and/or report to BSP at consumeraffairs@bsp.gov.ph or call (632) 8708-7087.

Equicom Savings Bank is regulated by the Bangko Sentral ng Pilipinas (BSP) with contact number (632) 8708-7087 and email address consumeraffairs@bsp.gov.ph.

Notice on Enchanced Card Security Feature for Online Transactions

A simple text from Equicom Savings Bank (EqB) can protect you from online fraudulent transactions. Here’s how to turn on/off your Equicom Savings Bank Card online transaction feature:

| Via Phone Call | Via SMS |

|---|---|

|

Step 1 Call the Equicom 24/7 Customer Service at (632) 8241~5952, (632) 8241-6711, or DTF 1-800-10-EQUICOM (3784266) |

Step 1 Text* ECOM 0N <Card Last Six Digits> to 09178803784 |

|

Step 2 Undergo positive identification (PID) |

Step 2 Wait for EqB’s text confirmation. |

|

Step 3 Update mobile number, whenever applicable. Wait for EqB’s confirmation. |

Step 3 Perform online transaction.** |

|

Step 4 Perform online transaction.** |

Step 4 To turn off your card online transaction feature, text* ECOM OFF to 09178803784 |

*Note: Mobile charges may apply.

** Online transaction feature will automatically turn off once online transaction is approved. Should the customer need to preform another online transaction repeat Step 1.

To take advantage of this facility, please ensure that your mobile number is updated. To update, please call the Equicom 24/7 Customer Service at (632) 8241-5952, (632) 8241-6711, or DTF 1-800-10-EQUICOM (3784266).

While overseas, please ensure your roaming service is active to receive important text alerts from EqB.

This change is essential for us to continuously provide you with the best service possible. We are glad to serve your banking needs and thank you for your continuous patronage.

Equicom Savings Bank is regulated by the Bangko Sentral ng Pilipinas (BSP) with contact number (632) 8708-7087 and email address consumeraffairs@bsp.gov.ph.

Notice on EMV Card

You can now pick up your new and improved Equicom Savings Bank ATM/Debit card equipped with EMV and Visa payWave features from your branch of account.

Please approach any of our branch personnel to get your new Equicom Savings Bank ATM/Debit card.

We are glad to serve your banking needs and thank you for your continuous patronage.

Equicom Savings Bank is regulated by the Bangko Sentral ng Pilipinas (BSP) with contact number (632) 8708-7087 and email address consumeraffairs@bsp.gov.ph.

Notice on Branch Consolidation

We would like to inform you that effective October 30, 2017, Equicom Savings Bank (EqB) will be consolidating the following branches:

| Branch Name | To Be Consolidated With |

|---|---|

| Cainta | Diliman |

| Caloocan | Legarda |

| Las Piñas | Alabang |

| Sta. Rosa | Calamba |

We welcome all our customers to call or visit us at our existing branch locations prior to the last banking day so we can make the transition seamless for all of our customers.

If you have any questions regarding the transition of your account/s, please approach any of our branch personnel to assist you or call us through the Equicom 24/7 Customer Service at (632) 8241-5952, (632) 8241-6711, or DTF 1-800-10-EQUICOM (3784266).

As always, thank you for banking with EqB through the years. We appreciate your business and we remain committed to meeting your financial needs.

Equicom Savings Bank is regulated by the Bangko Sentral ng Pilipinas (BSP) with contact number (632) 8708-7087 and email address consumeraffairs@bsp.gov.ph.